Northfield’s approved tax levy will increase $10,000 property-tax bill by $26, officials say

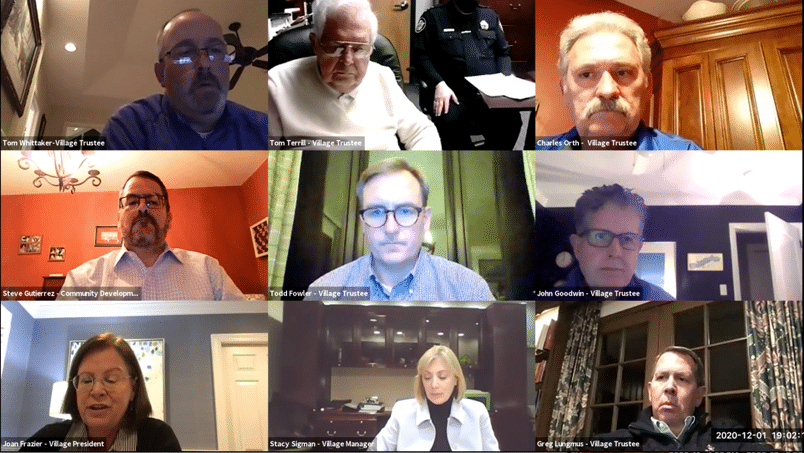

Northfield’s Village Board unanimously approved the village’s 2020 tax levy with a 2.3 percent increase over last year’s extension, the maximum amount allowed by the Consumer Price Index.

With the increase included and the exclusion of debt service, Northfield’s levy totals $4.54 million, according to village documents. Kyle Cratty, the village’s director of finance, said the operating levy would increase Northfield’s share of a $10,000 property-tax bill by $26.

Northfield is a home-rule village, so it is exempt from the property tax cap allowed by the CPI; however, its ordinance “pledges” compliance with the tax cap, Cratty says in a village memo.

Cratty told trustees during the Village Board meeting Tuesday, Dec. 1, that there are other portions of the tax bill already on file with Cook County. He said those portions are debt issuances that have been done in the past years.

Totals of those debt issuances equate to $6.09 million, he said, adding this brings the total levy for the village to $5.15 million. That total is a 1.7 percent increase over the 2019 levy.

“That 1.7 increase instead of 2.3 is primarily driven by the bond payments decreasing in the coming year for the three bond issues that have been filed in Cook County,” Cratty said.

First look at budget shows possible $500,000 deficit in ’21-’22

Earlier on Dec. 1, Northfield’s Committee of the Whole discussed the impact of the COVID-19 pandemic on the village’s projections and budget.

Village officials are anticipating an 8 percent decline in 2020 revenue projections, which would total approximately $886,000, according to a memo from Cratty to committee members. The decline is largely attributed to COVID-related reductions in sales tax, home rule sales tax, income taxes, interest income and building permit revenue, Cratty said.

Earlier this year, Northfield officials were estimating a revenue loss of approximately $1.5 million. One solution officials have discussed is allowing the sale of cannabis in the Northfield, as previously reported by The Record.

Steve Gutierrez, Northfield’s community development director, said during the Dec. 1 Village Board meeting that the zoning text amendments related to adult-use cannabis, which the board directed staff to prepare in October, will be finalized this week and sent to the Planning and Zoning Commission in January.

Officials are anticipating that Northfield will be under budget in terms of operating expenses.

“So far, staff has done a great job of controlling costs and we are projecting ending the year $178,907 under budget for expenses,” Cratty said in the memo.

Projection models for fiscal year 2021-22 estimate a revenue decline of about $292,067 and an increase in expenses, according to village documents.

If expenses remain consistent with previous five-year projections and there is no increase in revenues, Northfield will face a $489,000 budget shortfall, the documents show.

Citing a healthy reserve level, officials have indicated raises in fees or taxes are unlikely at this point; however, Cratty’s memo details several options the village may have to consider in the future, depending on the duration of the pandemic.

Those options, according to village documents, are: a real-estate transfer tax, a property tax increase over the maximum cap, the allowance of cannabis sales that would generate a 3 percent sales tax, a vehicle sticker increase and a home rule motor fuel tax.

Officials will begin preparing the 2021-22 fiscal year budget in January and a draft budget will likely be review in March, Cratty said.

Martin Carlino

Martin Carlino is a co-founder and the senior editor who assigns and edits The Record stories, while also bylining articles every week. Martin is an experienced and award-winning education reporter who was the editor of The Northbrook Tower.