Referendum would expand capabilities of Kenilworth Park District, support new rec center and connected Green Bay Trail

Jump To: Referendum Basics | Ballot Language

Kenilworth residents can now enjoy rebuilt and modernized amenities at Townley Field, and the Kenilworth Park District doesn’t want the fun to stop there.

To keep improvements going, the district is looking to its taxpayers to approve a tax increase, specifically a bump of 0.131 percentage points on the limiting tax rate. If the referendum is approved Nov. 5, the district’s new limiting tax rate, 0.321%, would bring in approximately $492,000, or 69.8%, more in property-tax revenue each year.

With the funds, the park district hopes to soon tackle three major projects:

• The relocation of Green Bay Trail, which at present awkwardly routes through Kenilworth’s residential streets;

• The construction of a new recreation center to replace the Village House and enable year-round programming; and

• Improvements to the athletic fields and other outdoor spaces on the north side of Townley Field

Park District Executive Director Johnathan Kiwala said a limiting-rate increase allows for more flexibility than a bond referendum, the proceeds of which must go toward a specified project. Kiwala said, because of the relatively small size of the Kenilworth Park District, any capital project likely would come with operational needs as well.

“This is really an expansion of the park district,” he said.

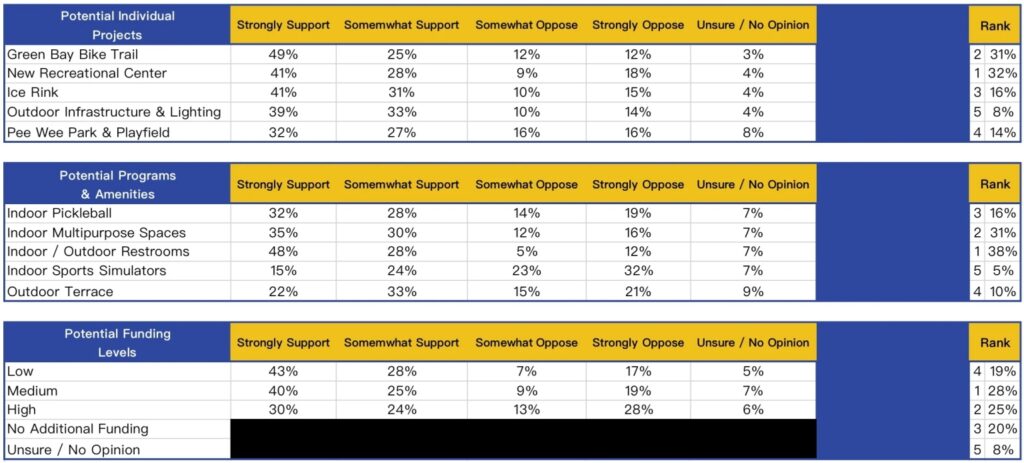

The park district’s push for the additional funding is partially informed by community feedback. In surveys about local recreation, respondents showed significant support for a rerouted Green Bay Trail (74%) and a new rec center (69%). Additionally, 72% of participants said they would support increased funding levels with 28% of that total preferring the “medium” level of funding — the level chosen by the district for the referendum — out of five options, including no funding and no opinion.

Park Board member Emily D’Souza said to move forward with the wishes of residents, a funding increase is necessary.

“If we really want to invest in our parks, which people really say they want … that comes at a cost,” she said. “I didn’t see anything wrong with putting referendum on the ballot. People can ultimately choose for themselves if it makes sense for them and their families. It would be really hard to provide the community with much more of updated buildings and things like that without any more money.”

Kenilworth Park District Limiting Tax Rate Referendum

Referendum Ask: ~70% increase to limiting tax rate (to 0.321%)

Additional Cost to Taxpayer (estimated, annual): $600 per $1.5 million in home value

Recent Referendums: 2015: Limiting rate increase of 0.062%, or an extra $162,000 in property tax revenue (approved)

Referendum Purpose: To collect approximately $492,000 in property-tax revenue per year for use in operational funds. Potential use of new funds include a new recreation center, relocation of portion of Green Bay Trail near Townley Field, and ongoing improvements to outdoor spaces at Townley Field

Ballot Question

“Shall the limiting rate under the Property Tax Extension Limitation Law for the Kenilworth Park District, Cook County, Illinois, be increased by an additional amount equal to 0.132% above the limiting rate for levy year 2023 for the purpose of building, equipping and operating a new community recreation center, acquiring and improving land for trail use, maintaining, improving and protecting park facilities, parks and athletic fields and for other park purposes and be equal to 0.321% of the equalized assessed value of the taxable property therein for levy year 2024? (1) The approximate amount of taxes extendable at the most recently extended limiting rate is $705,325, and the approximate amount of taxes extendable if the proposition is approved is $1,197,325. (2) For the 2024 levy year the approximate amount of the additional tax extendable against property containing a single family residence and having a fair market value at the time of the referendum of $100,000 is estimated to be $40. (3) If the proposition is approved, the aggregate extension for 2024 will be determined by the limiting rate set forth in the proposition, rather than the otherwise applicable limiting rate calculated under the provisions of the Property Tax Extension Limitation Law (commonly known as the Property Tax Cap Law).”

Joe Coughlin

Joe Coughlin is a co-founder and the editor in chief of The Record. He leads investigative reporting and reports on anything else needed. Joe has been recognized for his investigative reporting and sports reporting, feature writing and photojournalism. Follow Joe on Twitter @joec2319